What are Fintech Startups?

Introduction

Definition of Fintech Startups

Fintech stands for financial technology and refers to companies that use technology to provide financial services and support financial institutions.

Fintech startups are emerging companies that leverage new technologies like AI, blockchain, big data, and mobile to offer innovative financial products and services.

Overview of the Fintech Startup Landscape

The fintech startup space has exploded in recent years, attracting significant investment and changing how consumers and businesses access financial services.

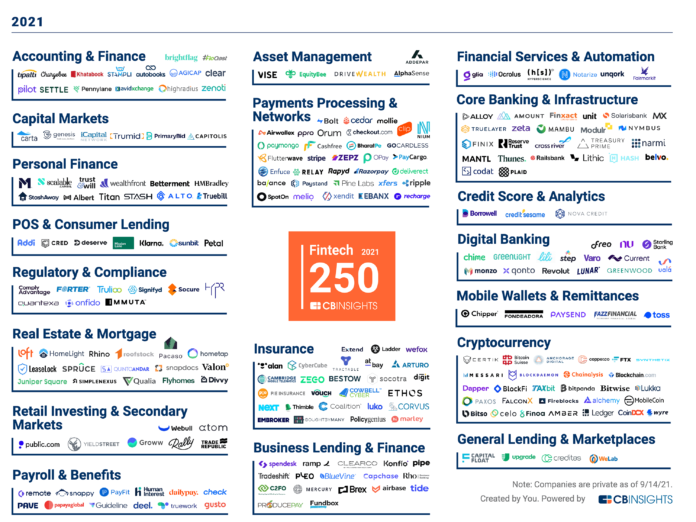

- Top fintech segments include payments, lending, wealth management, crypto/blockchain, insurtech, regtech, and embedded finance.

- Key drivers of fintech growth include smartphone adoption, consumer demand for digital financial services, COVID-19 pandemic accelerating digital trends.

Major Categories of Fintech Startups

Payments

- Startups like Stripe, Square, and PayPal that offer easy online payment processing and POS solutions for merchants.

- Digital wallets like Apple Pay and Google Pay that allow contactless mobile payments.

- Cross-border remittance apps like TransferWise that facilitate global money transfers.

Lending

- Digital lenders using alternative data like Affirm and Upstart that provide quick loan options and financing.

- Crowdfunding platforms like Kickstarter and GoFundMe that help fundraise for projects and causes.

Wealth Management

- Robo-advisors like Betterment and Wealthfront that provide algorithm-based investment management.

- Stock trading apps like Robinhood and Webull that offer commission-free trades.

- Cryptocurrency exchanges like Coinbase and Gemini for buying and selling crypto assets.

Insurtech

- Companies like Lemonade and Root Insurance that use technology to simplify and customize insurance policies.

- Usage-based insurance providers like Metromile that base premiums on real driving data.

Key Trends and Disruptive Impacts of Fintech Startups

Democratizing Access to Financial Services

One of the most significant trends in fintech is the push towards democratizing access to financial services. Fintech startups are lowering barriers to entry through digital platforms and mobile apps. This expands options for underserved groups like millennials, gig workers, immigrants, and rural communities. Solutions like mobile banking, online lending, and digital advisory services are empowering more people to take control of their finances.

Automating Manual Processes and Reducing Costs

By utilizing automation and AI, fintech companies are making financial services more efficient. They are taking time-consuming, paper-heavy processes like loan underwriting, identity verification, fraud detection, and client onboarding and turning them into seamless digital experiences. This reduces overhead costs and eliminates frustrating paperwork for consumers. The improved efficiency translates into lower fees, better interest rates, and faster services compared to traditional financial institutions.

Leveraging Alternative Data Sources and Machine Learning for Underwriting

Many fintech lenders and insurtech companies are leveraging big data sources and machine learning algorithms to enable more accurate and inclusive underwriting. By looking beyond credit scores to incorporate alternative data like education, career history, and digital footprint, they can evaluate risk in new ways. This allows them to qualify borrowers who may have lacked traditional credit history. The algorithms also replace manual review processes to deliver faster credit decisions.

Unbundling Services Offered by Traditional Financial Institutions

Fintech companies are excelling at unbundling the end-to-end services offered by banks and financial service providers. Instead of doing everything, fintechs are focused on delivering specific solutions – like payments, investing, lending or personal finance management. This laser focus allows them to innovate rapidly in their niche. As these unbundled services gain traction, customers are increasingly turning to curated fintech solutions rather than relying solely on multifunctional institutions.

Empowering Consumers with More Control Over Their Finances

Many consumers feel disconnected from big banks and dissatisfied with poor customer service and lack of transparency. Fintech apps provide always-available access, real-time notifications and personalized insights that help consumers better manage their money. Features like automated saving and investing, spend tracking, peer-to-peer payments and easy transfers empower people and give them more financial autonomy. This improved access to information and control over their own money is attractive for customers.

Most Well-Known Fintech Startups

Here are some of the biggest and most disruptive fintech startups transforming the industry globally:

Stripe

The payment processing startup Stripe has become one of the world’s most valuable private fintech companies, facilitating online transactions. Their developer-friendly APIs and flexibility have attracted millions of businesses worldwide.

Affirm

Affirm provides installment loans and “buy now, pay later” services as an alternative to credit cards. They have flexible payment options and serve customers excluded by traditional banks.

Plaid

Plaid builds APIs for connecting bank accounts and financial data to fintech apps like Venmo, Robinhood and Acorns. They enable smoother onboarding and enriched financial services.

Chime

Chime offers branchless mobile banking services and debit cards aimed at millenials. They have attracted millions of users with features like early paycheck access, automated savings and low fees.

Coinbase

A major crypto exchange, Coinbase makes it easy for mainstream audiences to buy, sell and manage cryptocurrencies like Bitcoin and Ethereum. They now have over 73 million verified users globally.

Robinhood

The zero-commission stock trading app Robinhood helped drive the boom in retail investing and democratize access to financial markets for everyday investors.

Outlook for Fintech Startup Growth

The future looks bright for ongoing fintech innovation and startup success:

Continued Investment and Increasing Startup Valuations

Venture capital and institutional investors are piling into fintech across all verticals. In 2021 alone, over $125 billion was invested globally in fintech companies. Lofty startup valuations will likely continue as funding pours in.

Consolidation and M&A Activity Will Increase

As the sector matures, consolidation will accelerate. Large fintechs will acquire smaller startups for their technology and specialized capabilities. Similarly, traditional financial institutions will likely scoop up fintechs to bolster their digital transformation and remain competitive.

Incumbents Will Partner With or Acquire Fintechs

Rather than competing, an increasing trend will be collaboration between fintech disruptors and incumbent financial institutions. Banks, insurance companies and other players will partner with fintechs or acquire them to benefit from their innovations.

Regulation Will Adapt to Promote Innovation While Protecting Consumers

As regulators include fintech-specific policies, they will aim to balance consumer protection with enabling responsible innovation. Approaches like regulatory sandboxes and special charters for fintechs may expand. The flexibility will allow cutting-edge solutions to thrive responsibly.

Conclusion

In summary, fintech startups are major catalysts for transformation in financial services. By combining emerging technology with customer-centric design, they are making financial solutions more accessible, affordable and convenient. Key focus areas like payments, lending, investing and crypto are driving disruption of established institutions. Despite regulatory and adoption challenges, fintechs are poised to reshape finance for the digital age. Their innovations hold promise to create a more inclusive, personalized financial system for everyone. While risks remain, the opportunities unlocked by fintech startups will have profound impacts on consumers, businesses and the economy as a whole for years to come.